Meet the New Chinese Consumer: Post-Pandemic Trends California Brands Should Know

Post-pandemic China is seeing the rise of a new, aspirational consumer class, led by Generation Z and younger Millennials. While the “躺平” (lying flat) ethos once captured youth disengagement, the mood has shifted toward a “经济上行风” (gust of rising fortunes), a renewed ambition to improve lifestyles and project optimism through spending. For California exporters, this signals a substantial opportunity. By offering products that connect culturally, inspire self-expression, and enhance quality of life, companies can tap into a market that is both eager and willing to pay for goods that elevate identity, well-being, and creativity.

Despite slower GDP growth and persistent economic uncertainties, recent research from McKinsey finds that consumer confidence in China has stabilized. Rather than pulling back, younger consumers are focusing spending on products that deliver personal fulfillment and emotional value, shifting consumption from mere recovery to more intentional, expressive purchasing patterns [1]. In this environment, the right exports supported by authentic branding and market insight can thrive.

China’s digital ecosystems are central to this trend. McKinsey’s 2025 State of the Consumer report highlights that brands must move closer to consumers by engaging through culturally relevant channels and fostering emotional proximity via social media [2]. Platforms such as Xiaohongshu (Little Red Book) have become trusted spaces for discovery, where peers, friends, and influencers shape purchasing decisions. This peer-driven influence is especially potent among Gen Z, who remain optimistic despite cost-of-living pressures, and who increasingly look to products that reflect their personal values.

One of the most striking examples of this new consumption is the rise of collectible culture as a vehicle for self-expression. Companies like Pop Mart have built billion-dollar businesses around limited-edition figurines, blind-box sales, and social-media-fueled excitement. China’s collectibles market was valued at US$23.3 billion in 2024 and is projected to grow to US$34.1 billion by 2030 [3]. California exporters of creative goods, design objects, and pop-culture merchandise can adapt these tactics, using limited runs, scarcity-driven marketing, and platform-ready visual appeal to capture attention and command loyalty in China’s trend-driven urban markets.

At the same time, there is a revival in intergenerational cultural connection, with heritage brands reimagining themselves for younger consumers. Moutai, the iconic baijiu distiller, has expanded beyond spirits into chocolates, ice cream, coffee, and fashion collaborations [4]. LaoPu Gold, a jeweller known for traditional gold and jade aesthetics, now produces designs that fuse ancient symbolism with contemporary streetwear style [5]. This modernized heritage space offers California food, beverage, and fashion exporters a path to embed products within cultural narratives that resonate deeply with young Chinese consumers.

Technology-driven aspiration is another defining force. Lifestyle-enhancing tech products, from 360-degree cameras like those produced by Insta360, to smart home systems, supplements, and consumer wearables, have become symbols of self-development and social status [6]. The post-pandemic wellness surge is reinforced by demographic change, rising health awareness, and the amplification of personal improvement journeys on social media. California companies producing portable tech, premium health products, and fitness-aligned goods are well-placed to export into this space.

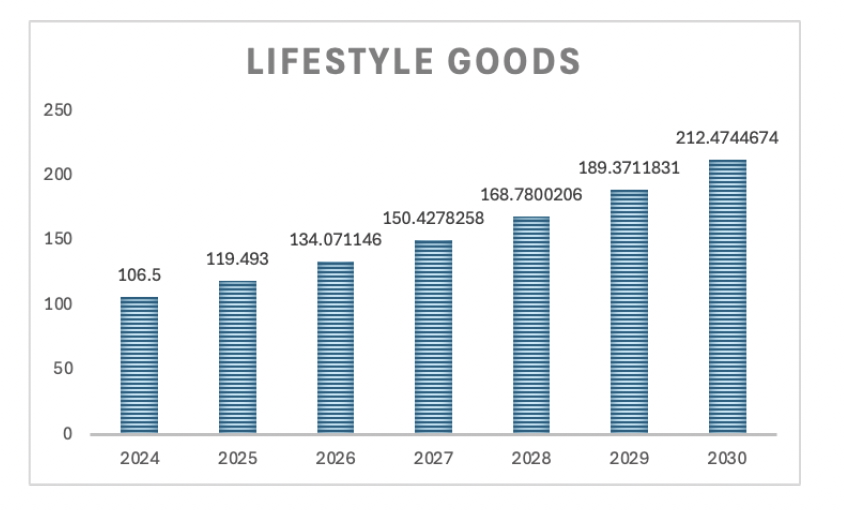

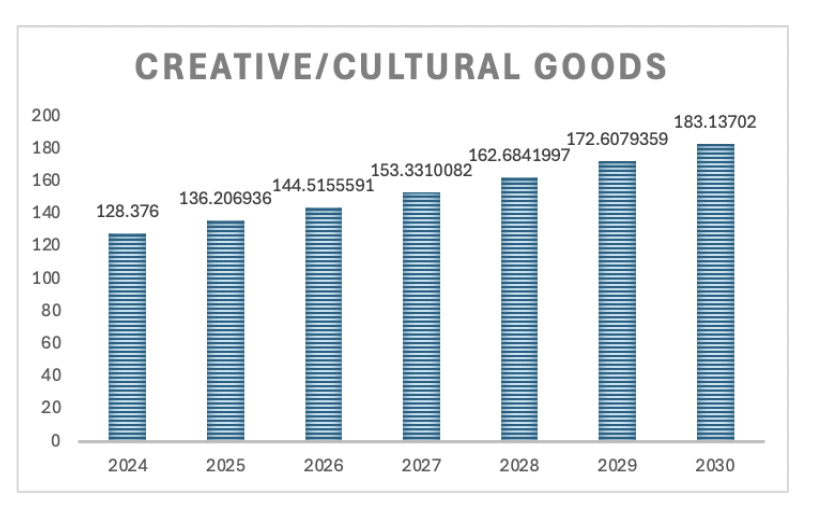

The scale of these opportunities is significant. In 2025, China’s lifestyle segment, which covers smart home technology, supplements, health foods, and wearables, was valued at approximately US$106.5 billion, with forecasts reaching US$212.5 billion by 2030 [7]. Cultural and self-expression categories, which include creative goods, jewellery, and collectibles, stood at US$128 billion in 2025, with a projected rise to US$183.7 billion by 2030 [8]. While other strategies such as local production or licensing may become more relevant in the future, the current market environment still rewards high-quality exports that meet these evolving consumer desires.

The China International Import Expo (CIIE) remains a premier platform to capture this demand. For California exporters, exhibiting at CIIE provides a rare chance to engage directly with buyers, distributors, and influencers in a concentrated setting designed for cross-border deal-making. By combining a nuanced understanding of post-pandemic consumer shifts with a targeted export strategy, California companies can position themselves at the forefront of China’s next chapter of consumption growth. To learn more about the California Pavilion at CIIE and the Bay Area Council’s services, contact Global Initiatives Director, Laurent Arribe at larribe@bayareacouncil.org.

FOOTENOTES:

[1] California: Trade & Investment, United States Trade Representative: https://ustr.gov/map/state-benefits/ca

[2] US-China Business Council – 2025 Member Survey

https://www.uschina.org/wp-content/uploads/2025/07/2025-Member-Survey-EN-1.pdf

[3] China – Healthcare (International Trade Administration, Country Commercial Guide) — https://www.trade.gov/country-commercial-guides/china-healthcare

[4] USDA Foreign Agricultural Service — Food Processing Ingredients Annual – China (CH2025‑0052), April 2, 2025: https://apps.fas.usda.gov/newgainapi/api/Report/DownloadReportByFileName?fileName=Food+Processing+Ingredients+Annual_Shenyang+ATO_China+-+People%27s+Republic+of_CH2025-0052.pdf

[5] China Beauty & Personal Care Market Report 2024, Kantar

https://www.kantar.com/inspiration/fmcg/five-key-focus-areas-for-chinas-beauty-market-in-2025

[6] McKinsey & Company — State of Beauty 2025: Solving a shifting growth puzzle: https://www.mckinsey.com/industries/consumer-packaged-goods/our-insights/state-of-beauty

[7] International Energy Agency — World Energy Investment 2025: https://www.iea.org/reports/world-energy-investment-2025

[8] National Energy Administration (PRC) — 中国新型储能发展报告(2025) (official PDF): https://www.nea.gov.cn/20250731/1d40d09f75714280a9218d5bea178fbd/202507311d40d09f75714280a9218d5bea178fbd_453d9a0609da1d4456a8b12d843bd256cf.pdf

[9] RMI — 2025 China Power Market Outlook: https://rmi.org/insight/2025-china-power-market-outlook/